The key battle in the TMS market: use standard treasury TMS solutions or customise

by Kylene Casanova

SunGard’s description of their implementation of their Quantum AvantGard Treasury Solution for Dubai Aluminium (DUBAL) shows all the issues, opportunities and tensions in implementing today’s TMS.

DUBAL’s corporate treasury department is responsible for managing the group’s global funding and investment requirements. Comprising 11 people located at the headquarters in Dubai, it also manages the group’s exposure to commodity, foreign exchange, interest rate and liquidity risk among its subsidiaries across the Globe. Previously, they used SAP with a combination of Excel and other systems as the central treasury solution:

Source & Copyright©2014 - SunGard

DUBAL realised they needed a Treasury Management System (TMS) to strengthen the financial risk mitigation and address their security concerns about the existing solution with its incumbent spreadsheet–driven environment. They also wanted to complement the enterprise-wide risk management initiative through integration with SAP Exposure Management for the identification of commodity and foreign exchange exposures.

New Quantum TMS based solution

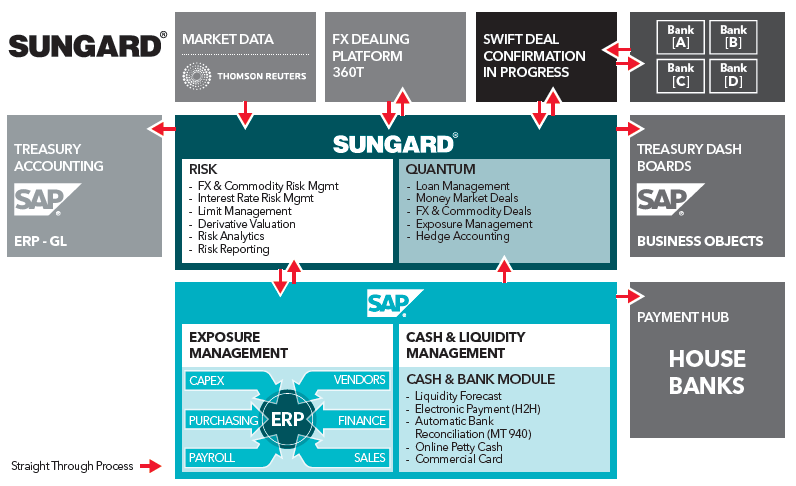

The new operational infrastructure and systems of the new solution is shown below:

Source & Copyright©2014 - SunGard

This new infrastracture contains a significant level of custom functionality developed specifically for DUBAL, including:

- Exposure Management: Financial risk exposures (FX & Commodity) from various business units are captured on a real-time basis in the core ERP system and sent directly to the tightly integrated AvantGard Quantum.

- Straight-Through-Hedging: SunGard’s Exposure Blotter is interfaced with 360 T FX dealing platform enabling two way transaction processing.

- Auto Hedge Accounting: Custom-developed “Auto Hedge Accounting” functionality in Quantum facilitates automatic creation of a hedge relationship (HR), linking the exposure with the corresponding FX derivative upon deal execution in the Exposure Blotter

- Risk Analytics features include: historical & Monte Carlo Value at Risk (VaR); option pricing & derivative valuation; spot-volatility stress testing; scenario & sensitivity analysis

- Commodity Risk Management: to accommodate DUBAL’s commodity hedging instruments and settlement.

The customisation and implementation of this solution took a year. DUBAL is clearly very happy with the new infrastructure and systems.

Future development

DUBAL and Emirates Aluminium are to merge to create Emirates Global Aluminium. DUBAL plans to roll-out the AvantGard Quantum solution to the newly created entity and all other companies within the group.

Future plans also include implementation of an In-House Bank (IHB) and SWIFT integration, as well as developing a comprehensive Cash Flow at Risk (CFaR) model.

CTMfile take: The DUBAL case is the ‘normal’ model for large relatively complex trading organisations. Buy a standard large scale system and then have special features and customisation developed for their particular needs. SAP Treasury wins few of these bids because, all too often, it is judged to not have the functionality to meet the complex needs of the larger corporates and also their development costs can be high and lengthy. But this is changing, there are global MNC’s who have simplified their corporate treasury operations and trading procedures to enable them to use the SAP Treasury solutions without huge customisation. This is the key battle in cash and treasury management systems: persuading corporate treasurers to use standard systems and services with NO customisation. Yes, the systems need to improve, but customisation increases costs considerably, lengthens implementation, and makes upgrades and reliability much more difficult.

Like this item? Get our Weekly Update newsletter. Subscribe today