The ultimate payments experience is invisible, but few get anywhere close

by Kylene Casanova

Adyen, the leading multi-channel payment systems provider, web-site starts with, “The ultimate payments experience is invisible. What steps can you take this year to bring you closer to this goal? In the world of commerce, convenience rules supreme.” This quote sums up the direction of travel of all types of payment system, although there are huge variations by system and location.

There continues to be a constant stream of new developments in payment systems, many of which are catch up, some are evolutionary, and only three are really revolutionary.

Catchup developments: there are too many to include (Also CTMfile wouldn’t get many thanks from product managers saying their new product was just catchup.)

Evolutionary developments have included:

- BofA Merrill Lynch have expanded ACH Payments capabilities on CashPro® so that now all corporate clients can make payments via CashPro to 60 Countries and in 22 Currencies

- Non-card, direct to bank payments are increasing, e.g. VocaLink and Barclaycard announced a partnership to enable their merchants to accept mobile payments through Pay by Bank app which will allow shoppers to pay quickly and securely for goods and services on a mobile device, without the need to enter credit or debit card details. By using the Pay by Bank app payment button at the point of purchase, customers can login to their mobile banking app which will seamlessly authorise and complete the transaction.

- real-time payment systems and services are rolling out world-wide:

- in the USA The Clearing House (TCH), which is owned by 24 US banks, has taken the initiative to build a brand new payment system from the ground up, utilising modern technology to finally provide a method for moving US payments in real-time. The Real-Time Payments (RTP) network is to launched later this year

- Faster Payments equivalents are being installed in many countries

- Consumers and businesses are moving to near real-time payments wherever possible, e.g in UK Faster Payments is growing at 14%/year while cheques decline at 15%

- Chinese payment providers are going global, e.g. Ant Financial, the company that operates Alipay, is buying MoneyGram for $880 million and Union Pay card scheme roll-out across Europe continues

- India continues to roll out digital payment services as they try to replace cash, e.g. HSBC have launched a Unified Payments Interface solution for corporates in India

- SEPA instant credit transfer system has been launched.

Revolutionary developments have included:

- The use of block chain in real-time cross-border payments:

- The National Bank of Abu Dhabi (NBAD) is the first lender in the Middle East to introduce real-time cross-border payments utilising blockchain technology.

- in October Emirates NBD announced, that it was working with Indian bank ICICI on a pilot project to use blockchain technology for global remittances and trade finance

- SWIFT’s GPI innovation programme progress in transforming international payments continues:

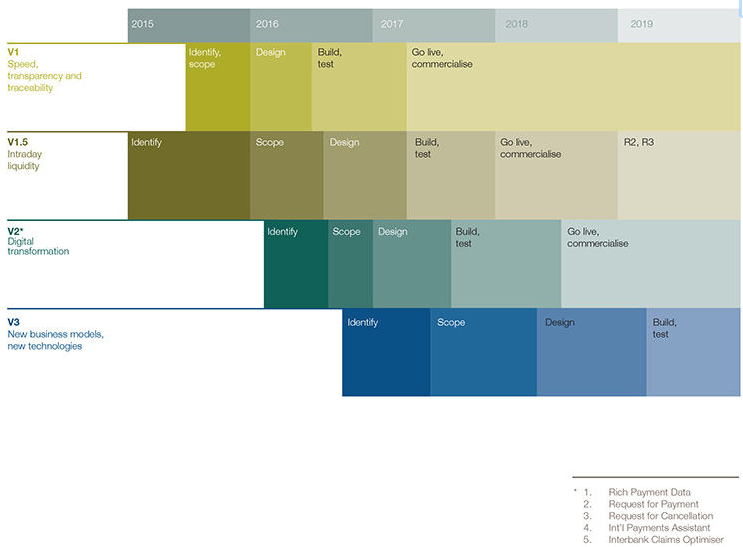

- The roadmap is impressive and ambitious:

Source & Copyright©2017 - SWIFT

Source & Copyright©2017 - SWIFT

- the launch of a Proof of Concept (PoC) to explore whether distributed ledger technology (DLT) can be used by banks to improve the reconciliation of their nostro databases in real time, optimising their global liquidity, see

- The roadmap is impressive and ambitious:

- New business models are being developed, e.g. Amazon Go’s ‘Self Checkout’ system threatens to change retailing for ever.

CTMfile take: Adyen are correct to say that ’In the world of commerce, convenience rules supreme.” No convenience = declining usage. These are exciting times in payment systems, however, we need to remember that little is really revolutionary.

Like this item? Get our Weekly Update newsletter. Subscribe today