Three near-term AI priorities for CFOs

by Ben Poole

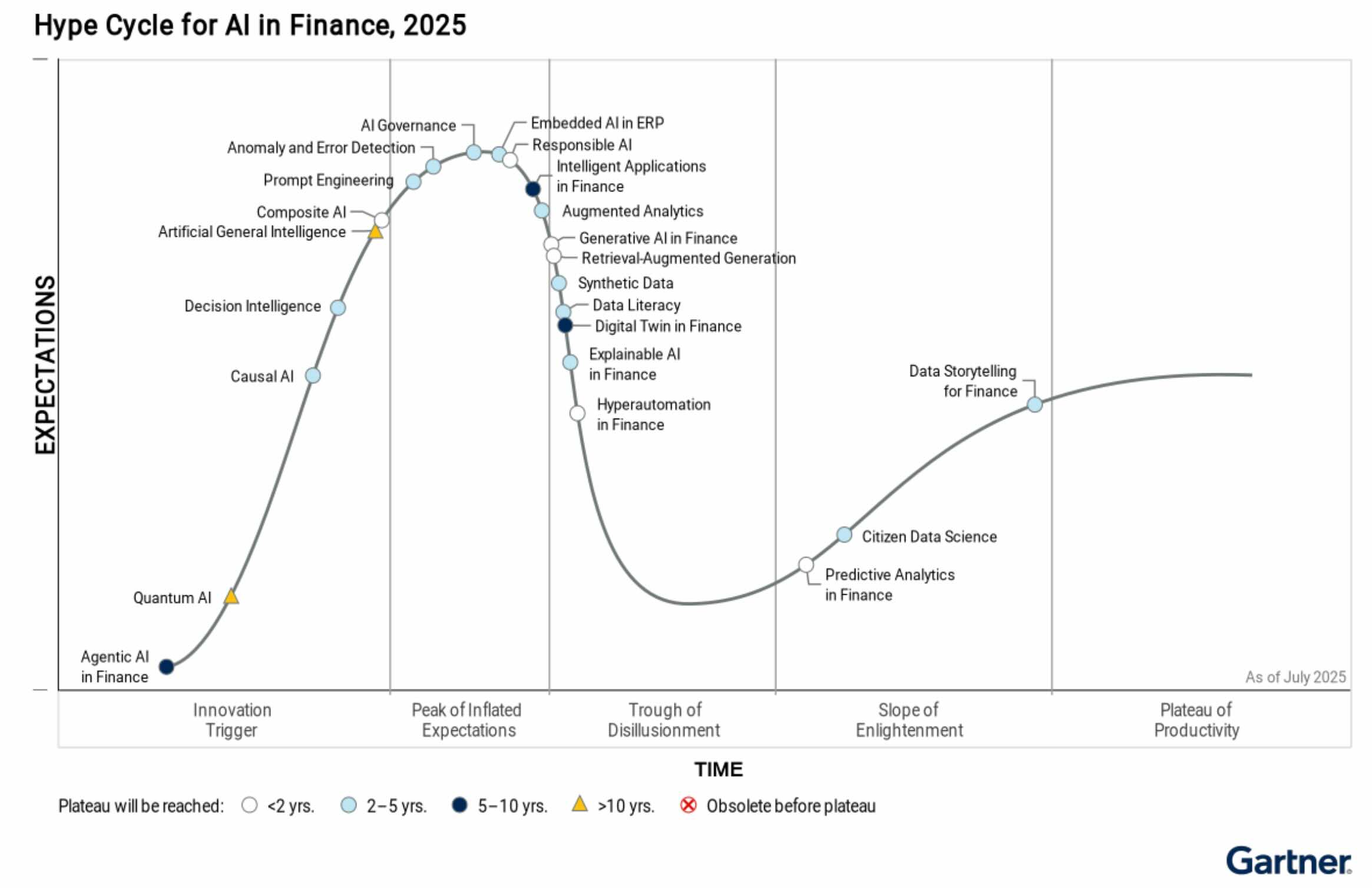

CFOs face an avalanche of artificial intelligence (AI) developments in finance. Separating hype from practical value has become a growing challenge, particularly as vendors race to embed new tools into financial applications and regulators push for ethical safeguards. Gartner’s latest research suggests finance leaders should concentrate on three areas that will have the most immediate and transformational impact: generative AI, composite AI, and responsible AI.

Alex Levine, director analyst in the Gartner Finance practice, says the pace of change can be daunting. “The pace and potential of AI developments in finance can be overwhelming,” he explains. “The AI in Finance Hype Cycle aims to help finance leaders cut through the noise and focus on technologies likely to have the most impact in the near-term.”

Gartner’s Hype Cycles track the maturity and adoption curve of technologies, from early innovation through to mainstream use. By mapping tools against business relevance and adoption timelines, they offer CFOs a framework for deciding where to place their resources. For 2025, three themes stand out: generative AI in finance, composite AI, and responsible AI. Gartner expects all three to reach mainstream adoption within the next two years.

Source: Gartner (September 2025)

Trend 1: Generative AI in finance

Generative AI (GenAI) has already reshaped the public’s perception of AI through tools like ChatGPT, Microsoft Copilot and Google Gemini. The enterprise market is moving just as quickly. Gartner’s 2025 Finance Technology Bullseye Report forecasts that 80% of independent software vendors will embed GenAI capabilities into enterprise applications by 2026, up from less than 5% in 2024.

“Finance leaders are looking for technologies that help them to collect, review and assess the growing amount of data in the increasingly complex world of finance operations,” says Levine. “Top finance technology vendors know this and see GenAI as a top competitive area, differentiating their products on enterprise readiness, pricing, infrastructure, safety and indemnification.”

For finance functions, the use cases are multiplying. GenAI models can produce cash-flow forecasts, automate reconciliations, draft management reports, and flag anomalies in real time. By increasing robustness and accessibility, these models are moving beyond pilots and into day-to-day treasury and finance operations. Gartner expects their influence to be felt across most finance functions within two years.

The implications for CFOs are significant. Early adopters are likely to achieve sharper visibility, lower processing costs, and faster decision-making. Yet investment choices will require scrutiny. Not all GenAI models are created equal, and finance leaders must weigh enterprise-grade readiness and risk safeguards before committing to long-term deployments.

Trend 2: Composite AI

While generative tools dominate headlines, composite AI (or hybrid AI) may prove just as critical. This approach integrates multiple AI techniques, including machine learning, deep learning, rule-based reasoning and optimisation methods. Rather than relying on one model, it combines strengths across different methods to produce broader and more resilient insights.

“The business impact of composite AI is significant, as it enables organisations with limited historical data but strong domain expertise to leverage AI for more complex reasoning tasks,” says Levine. “It’s especially valuable for organisations seeking to move beyond narrow, data-driven models to solutions that incorporate human expertise and adapt to diverse scenarios, making it a key driver behind the latest GenAI implementations.”

Composite AI underpins emerging fields such as decision intelligence platforms and agentic AI, which use reasoning to take actions on behalf of users. For corporate finance teams, this could mean systems that not only flag liquidity risks but also recommend actions based on multiple scenarios.

However, composite AI is not without challenges. Combining different models requires expertise that many finance functions currently lack. Managing these models, often referred to as ModelOps, adds further complexity. Trust, security and ethical safeguards also become harder to maintain as systems grow more sophisticated. For CFOs, this means viewing composite AI as a long-term investment in capability, requiring both skilled staff and governance frameworks.

Trend 3: Responsible AI

If generative AI drives adoption and composite AI expands functionality, responsible AI (RAI) will determine whether these advances are sustainable. RAI provides a framework to ensure AI systems are ethical, transparent, fair and accountable. It spans risk management, trust, explainability, bias mitigation, privacy, safety, sustainability and compliance.

“RAI currently flies under the radar for many finance leaders, but it is vital to understand and get right for long-term AI success,” says Levine. “The importance of RAI has grown as AI becomes more deeply integrated into business and society. RAI practices are increasingly formalised through governance structures and industry regulations, requiring organisations to address both organisational and societal responsibilities.”

The pressure is not just theoretical. Europe’s Artificial Intelligence Act, along with emerging US and Asian regulations, places compliance obligations on companies deploying AI systems. For finance leaders, this means proving that AI-driven decisions are auditable, unbiased and reliable. Transparency will be essential in areas such as credit assessment, capital allocation and fraud detection, where errors or hidden biases could have material consequences.

Societal expectations also matter. Customers, employees and regulators increasingly demand that AI be used responsibly. For CFOs, aligning AI projects with ethical and regulatory boundaries is becoming a precondition for adoption. The risk of reputational damage now sits alongside the risk of operational failure.

Implications for CFOs

Taken together, Gartner’s three focus areas suggest a two-track agenda for finance leaders. On one side, generative AI and composite AI offer the tools to improve speed, insight and resilience in finance operations. On the other, responsible AI provides the guardrails that ensure adoption does not outpace governance.

CFOs must balance experimentation with caution. Investing in pilots for generative and composite AI will help build experience, but these should run alongside responsible AI frameworks to address issues such as bias, explainability and compliance.

The broader message is that AI adoption is no longer optional. As vendors embed AI into financial systems by default, finance leaders who delay engagement risk being left behind. Yet those who move too fast without ethical safeguards may expose their organisations to regulatory or reputational shocks.

For treasurers and CFOs alike, the next two years will be decisive. The technologies highlighted by Gartner are moving rapidly towards mainstream use, promising both efficiency gains and new complexities. Keeping AI strategies anchored in business goals, while embedding responsible practices, will be the test of leadership.

Like this item? Get our Weekly Update newsletter. Subscribe today