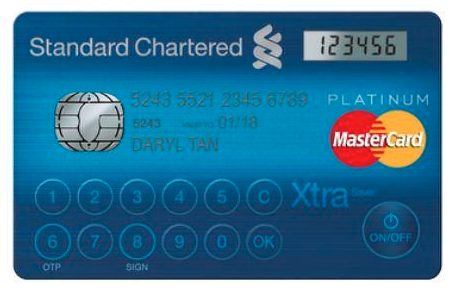

Token verification will be everywhere, e.g. Standard Chartered Singapore embeds security tokens in c

by Kylene Casanova

Standard Chartered Bank's Singapore unit has unveiled a payment card featuring an embedded security token for online transactions to comply with the Association of Banks in Singapore plans to start issuing on-line tokens with enhanced features such as " transaction signing " as part of an industry-wide security push.

Standard Chartered is first out the blocks, giving online and mobile banking customers the option to replace their existing credit, debit or ATM cards with the security-token one.

The card contains a 12-digit key pad which customers use to enter transaction specific information - such as the last four digits of an account number - to generate a security code which appears in a display. This number is then entered online to verify the user.

The token feature will be used from January for logging into on-line and mobile banking, adding third party payees, transferring or making payments in amounts above a defined threshold, increasing daily transfer or payment limits, updating personal details, and changing on-line banking passwords.

The use of tokens for verifying account holders will grow and grow. This is just one example of how tokens will be carried, rather than in the bulky calculator type devices. There will be token verification features in many other devices, expect them in Google's wallets, Apple's Passbook, etc.

Like this item? Get our Weekly Update newsletter. Subscribe today