Treasury cash forecasting: Rising expectations, growing complexity, AI’s promise

by Pushpendra Mehta, Executive Writer, CTMfile

Cash is a corporation’s most precious liquid asset, and treasury is its guardian. Accurate and efficient cash forecasting is therefore critical—not only for effective cash and liquidity management but also for giving corporate treasurers actionable insights into future cash flows.

Over the past five years, corporate treasurers have faced a range of challenges, yet the need for timely and reliable cash forecasting has remained a key priority. Accurate forecasts enable informed financial decisions, even during uncertain and transformative times.

To optimize short-term cash, minimize funding costs, respond quickly to changing business conditions, and capitalize on opportunities, treasury executives must leverage data-driven cash forecasting insights.

In this article, we present key statistics, trends, and insights from select 2025 survey reports. These data points offer practical guidance and operational intelligence for corporate treasury professionals striving to improve forecasting accuracy, enhance decision-making, and stay ahead in an ever-evolving financial landscape.

Management expectations around cash forecasting are rising

According to the 2025 Cash Forecasting & Visibility Survey Report, sponsored by TIS and powered by Strategic Treasurer, management’s expectations for cash forecasting have increased across multiple aspects.*

Sixty-eight percent of companies reported higher expectations, while only 1% saw a decrease, and 32% indicated expectations remained about the same. When asked which aspects of forecasting were under greater scrutiny, respondents highlighted:

- Greater accuracy required (76%)

- More review and attention from management (69%)

- Increased emphasis on variance analysis (51%)

- Use of more forecasting models (45%)

- More frequent forecasts (41%)

- AI/ML adoption to support cash forecasting (28%)

These findings underscore how critical forecasting accuracy and timeliness have become for corporate treasury. The push from management reflects not only a demand for better insights into liquidity but also a stronger reliance on technology and advanced analytics to support decision-making.

Forecasting is increasingly perceived as challenging

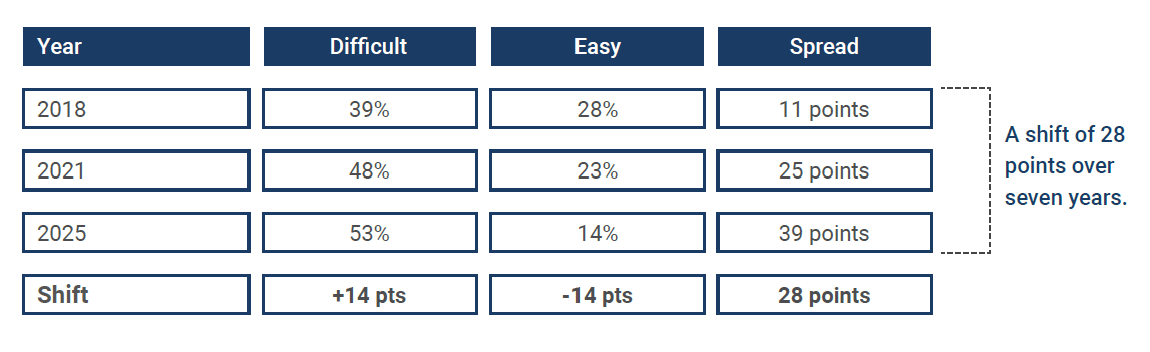

While management’s expectations for greater accuracy and precision in forecasting continue to rise, treasurers are simultaneously finding the process more difficult. The 2025 Cash Forecasting & Visibility Survey reveals that the perception of cash forecasting as “easy” has been cut in half over the last seven years — falling from 28% in 2018 to just 14% in 2025.

Source: 2025 Cash Forecasting & Visibility Survey Report

Conversely, the number of organizations reporting that forecasting is “difficult” (somewhat or extremely) climbed from 39% in 2018 to 48% in 2021, and further to 53% in 2025. This 14-point jump reflects both heightened management scrutiny and the growing complexity of forecasting, given the increase in bank accounts, entities, and data sources that treasurers must manage.

The widening spread between “difficult” and “easy” perceptions — from 11 points in 2018 to 39 points in 2025 — represents a 28-point shift that highlights how much more challenging forecasting has become. These findings suggest that treasurers not only need better tools and methodologies but also must adapt to an environment where forecasting precision is expected despite rising complexity.

Cash management and forecasting remain top treasury priorities

Despite increasing complexity and the perception that forecasting has become more difficult, cash management and forecasting continue to dominate treasury priorities. The Association for Financial Professionals® (AFP) 2025 Treasury Benchmarking Survey Report notes that 73% of practitioners cite cash management and forecasting (including scenario analysis) as their top priority—up from 68% in 2022.

This emphasis is consistent across organizations of varying revenue sizes: 79% of enterprises with annual revenue under US $1 billion view cash management and forecasting as their highest priority, compared to 73% of larger organizations with revenue of at least $1 billion. The alignment is also evident across roles, with 73% of senior treasury executives and 74% of treasury professionals prioritizing it.

This consistency reinforces a clear message: regardless of company size or treasury role, the leading priority for treasury teams is cash management and forecasting.

AI to improve cash forecasting accuracy

As cash forecasting accuracy remains a persistent challenge, treasury practitioners are increasingly turning to technology for solutions. The just-released AI in Treasury & Finance Survey Report by Strategic Treasurer shows that a majority now prefer applying AI to address cash forecasting and reconciliation challenges.

Expectations for AI’s role have strengthened across nearly every category. For example, the share of practitioners expecting AI to improve cash forecasting rose from 65% in 2024 to 76% in 2025. Likewise, those who believe AI can reduce the burden of manual reconciliation tasks increased from 55% to 62% over the same period.

Together, these findings demonstrate that treasury teams are prioritizing cash visibility and forecasting while embracing AI to close the persistent accuracy gap and relieve the burden of manual processes.

To conclude, cash forecasting has never been more important—or more complex—for corporate treasury. Heightened management expectations, greater oversight, and the growing difficulty of generating reliable forecasts highlight the mounting pressures treasurers face. Yet the persistence of forecasting and cash management as the function’s foremost priority demonstrates how essential these activities remain to organizational resilience, decision-making, and growth.

The latest survey data marks a pivotal moment: treasury leaders are progressively relying on AI and advanced analytics to enhance accuracy, ease manual workloads, and gain deeper visibility into future cash flows. By adopting these tools, treasurers can not only meet higher expectations but also position themselves as strategic partners, delivering the timely insights businesses need to thrive in a volatile and fast-changing environment.

⃰ Disclosure: Strategic Treasurer owns CTMfile.

Like this item? Get our Weekly Update newsletter. Subscribe today