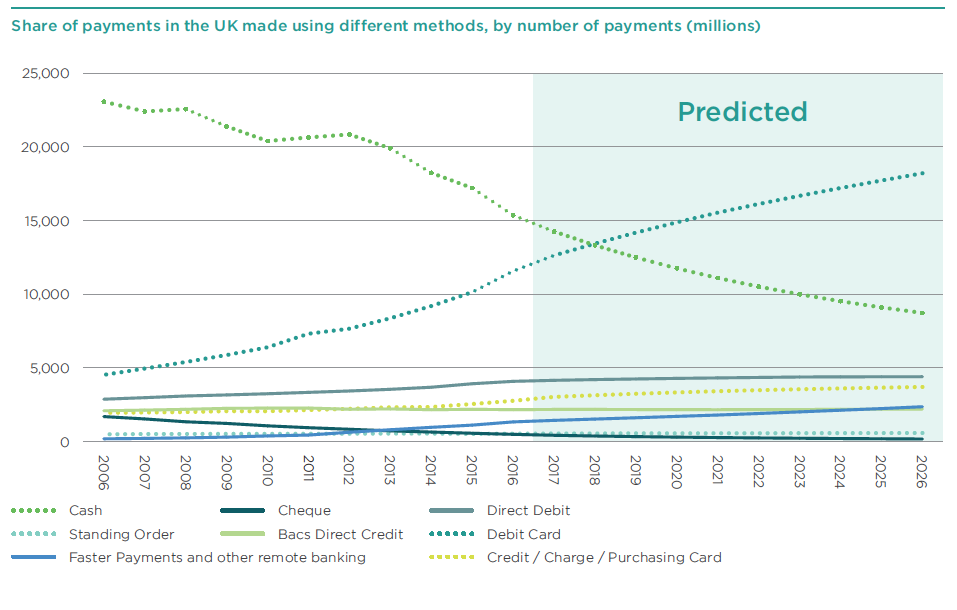

Debit cards to overtake cash in UK by 2018

by Kylene Casanova

UK Payment Markets 2017 Report published yesterday by Payment UK showed that debit cards will overtake cash by 2018 due to popularity of contactless. Other stats included:

In 2016:

- Cash was still the most frequently used payment method in 2016, used for 15.4 billion payments.

- Debit cards were used 11.6 billion times in 2016, 14% more than the previous year, with just over one in five of these transactions made using contactless.

- 4.1 billion Direct Debit payments, worth a total £1,262 billion, were made in 2016.

- 3.7 billion Credit card usage grew in 2016, with 2.8 billion payments made - up 9% year-on-year.

- 2.1 billion Bacs Direct Credit payments were made in 2016.

- 2016 saw 1.3 billion payments made via remote (online or mobile) banking. These payments were transmitted via the Faster Payments Service or cleared in-house.

- 471 million cheque payments were processed in 2016, down 14% from 2015.

- 39 million CHAPS payments worth £75.6 trillion were made – 0.1% of the volume, but 90% of the value of UK payments.

UK trends from 2006 and predictions

Source & Copyright©2017 - Payments UK

2026 forecast

- 18.2 billion debit card payments forecast for 2026, 57% more than 2016.

- 8.7 billion cash payments predicted for 2026 – down 43% from 2016.

- 4.4 billion Direct Debits payments predicted in 2026 up from 4.1 billion in 2016.

- 3.7 billion Credit card payments forecast up from 2.8 billion in 2016.

- 2.2 billion Bacs Direct Credit payments.

- 2.3 billion remote banking payments, 1 billion more than 2016, transmitted via the Faster Payments Service or cleared in-house.

- 156 million cheque payments, down 315 million over 10 years.

- 43.5 million CHAPS payments, up 4.5 million from 2016.

Managing the risks from debit cards

Barclays Bank in UK is allowing customers to "turn off" their debit card to online purchases and/or set daily ATM limits to reduce scams as cardholders become increasingly concerned. The bank's app now includes an option to reduce daily ATM withdrawal limits, from the typical level of £300.

Like this item? Get our Weekly Update newsletter. Subscribe today