What will a hard Brexit mean for British manufacturing?

by Bija Knowles

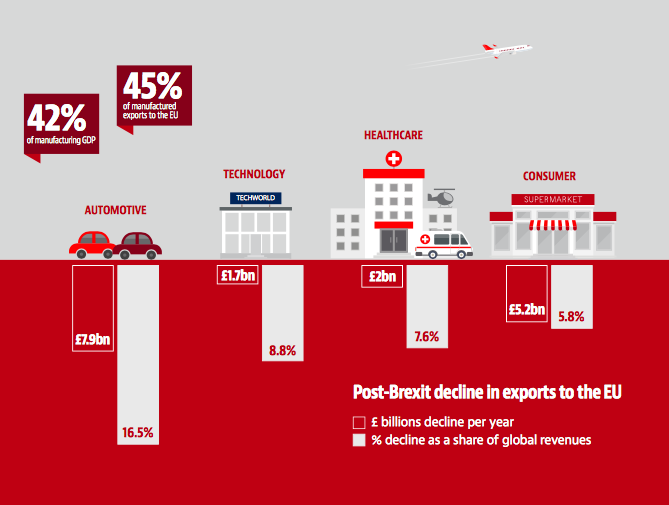

A report by Baker McKenzie looks at how a 'hard Brexit' will affect four sectors: automotive, consumer, healthcare and technology industries. The report – The Realities of Trade After Brexit – looked at what it would mean for those four sectors, which are a central part of British manufacturing, if the UK leaves the Single Market and the EU customs union. The four sectors account for 42 per cent of UK manufacturing GDP and 45 per cent of manufactured exports to the EU. It published the following key findings:

- a hard Brexit would lead to a fall of almost £17 billion in annual EU export revenues across the four sectors;

- the four sectors would face increased costs for exporting to the EU, in the form of both tariff and non-tariff barriers, which would total £3.8 billion;

- the proportionate fall in UK global exports would be four times that of EU exports in key manufacturing sectors;

- new trade deals with third markets could offer the best opportunities for UK exports – particularly the US; and

- UK manufacturing exports to target third markets would need to increase by 60 per cent to offset 'hard Brexit' EU export losses.

The report projects a decline in exports to the EU in all four sectors – as shown in the figure below. The automotive sector will be hit hardest, as it faces a £7.9 billion fall in exports per year or a 16.5 per cent decline as a share of global turnover.

The report also looks at the impact that tariffs and customs duties will have on trade between the UK and the EU, if the UK leaves the Single Market and customs union. It also shows how other costs incurred by a hard border between the EU and the UK could lead to additional high costs. The report states: “These non-tariff barriers include new compliance paperwork and other administrative requirements. Indeed, in a worst-case scenario, the UK would have to comply with the import procedures presently applied by the EU to all third countries.”

The report makes it clear that the UK will stand to be the bigger loser if EU trade talks fail. In the four industries considered in the report, the modelling shows that the UK is highly dependent on the EU, while the UK accounts for just a small proportion of exports from the EU. According to Baker McKenzie, “In the automotive sector, as a result of reduced exports to the UK, EU export revenues are projected to fall by 4.3% globally. In contrast, the UK automotive sector stands to lose more than 22% of its global export revenues owing to reduced EU export revenues – more than five times the loss... There is a similar story in each sector.”

CTMfile take: The message of the report is that a hard Brexit scenario will be damaging for companies in the four sectors analysed (cars, healthcare, consumer, tech). Companies need to consider the wide range of possible scenarios and how these will affect their supply chains. They also need to consider the third-country opportunities and how they could make their needs and views clear to the British government through lobby groups.

Like this item? Get our Weekly Update newsletter. Subscribe today