Changing goalposts for corporate treasurers

by Jack Large

It is amazing what you can do with the results from interviewing 76 corporate treasurers. Greenwich Associates seminal report Forward and Upward: Changing KPIs Force Treasurers to Improve takes a deep dive into what corporate treasurers/corporate treasury departments do and what their KPIs are.

First, the report defines beautifully and succinctly what the corporate treasury department does:

Corporate treasury is the guardian and anchor of the financial health of the corporation.

They found, in their study of the KPIs in corporate treasury, that corporate treasury is undergoing fundamental changes viz:

- Key performance indicators (KPIs) for the great majority of treasury departments have changed over the past five years

- Treasurers are being asked to look further forward into the future and upward to address more strategic concerns.

- Corporate treasury departments are now seen as centres of analytic excellence and are being asked to play a role in transforming as well as securing the firm.

Greenwich Associates conducted electronic interviews with 76 corporate treasury executives from large, global industry-leading multinationals based in the United States. It is the detail in this report that is both fascinating and revealing. This is important because 89% of treasury officials interviewed said that their KPIs have changed in the past few years.

The Day to Day: Responsibilities of Corporate Treasurers

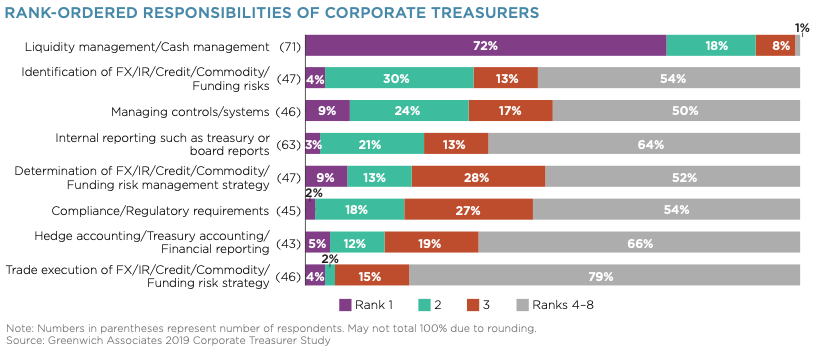

The survey showed that the main responsibilities of corporate treasurers today are:

The respondents ranked were then asked to rank their responsibilities:

How KPIs are changing and how corporate treasurers their spend time

How precisely the KPIs are changing reflects a wide shift in the philosophy of the corporate treasurer role. Greenwich Associates believe that the main objective is no longer merely to “run the firm.” Now it is to “change the firm.”

As their KPIs have shifted toward a longer-term strategic focus, treasurers have responded. This is most visible in how treasurers spend their time – see chart below. Across all treasurers, the No. 1 use of time is working on one-off projects. This is not true for the smallest firms in the sample, those with revenues under $2 billion.

The top three projects varied considerably, but generally fell into three categories:

- projects that focused on the operational efficiency of the treasury department itself

- strategic projects in line with the shift in the KPIs, e.g. forecasting, rationalizing banking relationships, optimizing capital structure, and executing M&A transactions

- risk-focused, e.g. improvement in data collection, improvements in risk methods or selection of counterparties.

Top risks managed by corporate treasury

The survey found, not surprisingly, that the top risks to be managed were liquidity and interest rates.

The report also reviewed the % rate and FX hedging strategies used by corporate treasurers, and the tools used to manage their risks and showed that, even in huge companies, spreadsheets remained the dominant system used.

Moving toward the ideal

This part of the report was probably the most important because the study found that:

- By far the No. 1 need was to improve the connectivity between the treasury department and the rest of the firm

- Many corporate treasury departments do not have their own technology budget

- Allocation of corporate treasury department’s technology budget is not easy with the majority of investment is for variable and driven by one-off projects and implementations.

Ken Monahan, a Senior Analyst at Greenwich and the lead author of the report, commented on their work, “What surprised me about the results was the lack of agreement on best practices. Treasurers have standard tasks such as cash management and risk management, but each treasurer we spoke with approached these differently. Overall, treasurers need more bespoke technology tools, especially as their organization grows.”

**

CTMfile take: This excellent 14-page report is worth reading by banks and corporate treasury operation managers. It raises as many questions as it answers which is what a great report does. It shows where the problems and the opportunities are.

Like this item? Get our Weekly Update newsletter. Subscribe today