Companies lost ~$11bn to FX in 3Q 2016 & look out for more extreme FX volatility

by Kylene Casanova

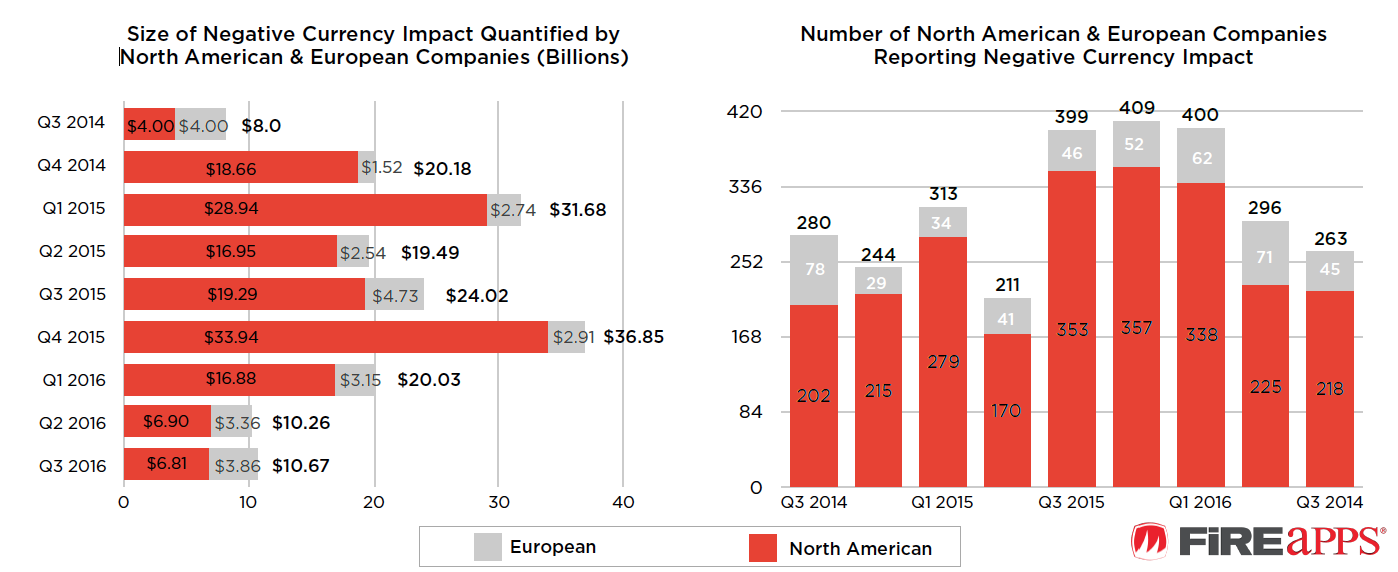

The latest FiREapps Currency Impact Report* reveals that companies lost nearly $11 billion to currency impacts in the third quarter of 2016, according to our latest analysis of the earnings calls of 1200 publicly traded North American and European companies. A total of 263 companies – 218 in North America and 45 in Europe – reported negative currency impacts. Of the companies actually quantifying the impact, the total quantified negative currency impact in Q3 2016 was $10.67 billion – $6.81 billion in North America and $3.86 billion in Europe.

Source & Copyright©2017 - FiREapps

The full blog and report is available here.

Conclusions

FiREapps believe that the two key takeaways from their analysis are that:

1. A $10.67 billion impact is average from a historical perspective, but still $8 billion too high

- A $10.67 billion total currency impact across North American and European companies is about average. But considering it represents cash that would have otherwise flowed into corporate coffers, it is still too high. Companies reported an average EPS impact of $.04 in the third quarter, which is four times higher than the management objective set by many companies. If the EPS impact had been $.01 or less, the total impact would have been about $2.67 billion – $8 billion less than what it actually was.

- Furthermore, the actual impact might have been much higher. A number of companies that had quantified quarterly impacts in the third quarter of 2015 (many of them among the largest impacts) did not quantify impacts in the third quarter of 2016. For example, McKesson Corporation quantified a currency headwind of $1.4 billion in Q3 2015 but did not quantify any impact in Q3 2016. General Electric quantified a headwind of $1.2 billion in Q3 2015 but did not quantify any impact in Q3 2016. Johnson Controls ($600 million), Delta Airlines ($235 million), and Staples ($224 million) are other companies that quantified significant negative impacts in Q3 2015 but did not quantify any impacts in Q3 2016. The question for investors is whether these companies did not quantify any currency impact in Q3 2016 because they did not have material impacts, or because they struggled to assess their exposures and quantify the impact of extreme volatility.

2. Currency impacts are manageable

- Some people might wonder if currency impacts to corporate earnings are so consistently high, perhaps currency risk is not manageable. But we know it is manageable. Many of the companies we work with came to us precisely because they had faced significant currency impacts and are now managing currency risk so their impacts are well below the $.01 EPS threshold. Managing risk well comes down to understanding exposures – and understanding all exposures across the portfolio of currencies a company does business in.

Look out for more extreme volatility

FiREapps predict, “There is potential for volatility more extreme than it has been in a long time, due to currency surprises not priced into the market. We should expect market gapping, where the market falls dramatically after a surprise. We saw such market gapping in the mid 1980s. Now, it will be caused in large part by rhetoric from leaders in the world’s largest economies (the United States and China), which the market does not yet know how to interpret.”

Action needed

FiREapps are finding that CFOs, CEOs, and even boards becoming aware of and asking questions about currency risk as they begin to understand the materiality of how currency can impact the financial picture of their companies. However, understanding is not enough, companies need to do something about it

———

* Report is part of FiREapps’ ongoing effort to provide insight into how currency affects corporations, every quarter they analyze the earnings calls of 1200 publicly traded North American and European companies (dubbed the “FiREapps 1200”). The companies included in this data set are large multinational firms with at least 15% international revenues in at least two currencies.

CTMfile take: FiREapps are right to point out that the losses to currency exposures are “still $8 billion too high”. Positive action is required by companies. Today the holy grail solution to currency losses is a combination of FiREapps and Hedge Trackers, see important article here.

Like this item? Get our Weekly Update newsletter. Subscribe today