Desire to control fraud is driving the use of payment systems and increasing cyberinsurance

by Kylene Casanova

developments revealed the pressures on companies and corporate treasury departments around the world.

Payment centralization

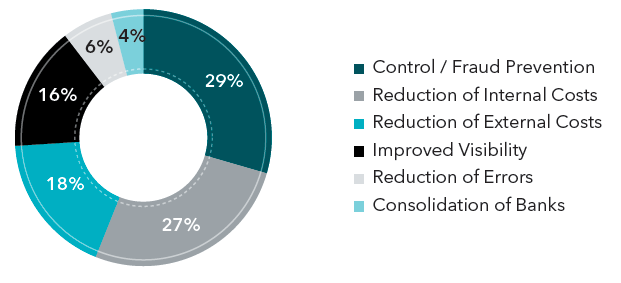

A recent report by SunGard on ‘B2B payments and bank connectivity’ revealed, in their survey of companies with &S$1bn+ turnover in all regions, that the desire to reduce fraud risks and increase controls emerged as the main drivers of payments centralization projects, followed by reduction in either internal or external costs, as figure below shows:

Drivers of payment centralization

Source & Copyright©2014 - SunGard Inc.

SunGard have found that to centralize payments effectively, organizations first should undergo a standardization of their payments processes. However the SunGard study shows that, of organizations with revenues over US$1 billion, only 20% follow standardized and controlled payment management workflows across all of their entities. A thorough organization-wide analysis of payments processes can lead to better understanding of areas for improvement and areas that can benefit the most from further examination. Standardizing payment processes strengthens governance and delivers cost efficiencies, while centralization delivers even greater cost benefits.

Cyberinsurance in the USA

The May edition of AFP fraudwatch reports that: “Treasurers of retail chain stores said they expect their companies will spend as much as triple the amount they already pay for cyberinsurance in the wake of the Target security breach. That’s on top of devoting additional employee hours preparing reports to show senior management and board members their cybersecurity measures.”

CTMfile take: Fraud prevention was not in the top 10 Global Risks for 2013-2014, but surely it should have been. Ignore fraud at your peril. Cyberfraud is costing billions world-wide, how much is it costing/will it cost your company?

Like this item? Get our Weekly Update newsletter. Subscribe today