Deutsche Bank launches first paperless import payment solution in India

by Jack Large

Slowly but surely global trade is being digitised. The latest example is Deutsche Bank’s TradePay in India which uses the Reserve Bank of India’s Import Data Processing and Monitoring System (IDPMS) to verify import payments by checking them against details made available by the client on the system, eliminating the need for clients to share any physical documentation. The data is then enriched by the client to meet regulatory requirements, validated by Deutsche Bank and converted into a payment-ready state.

Completely paperless

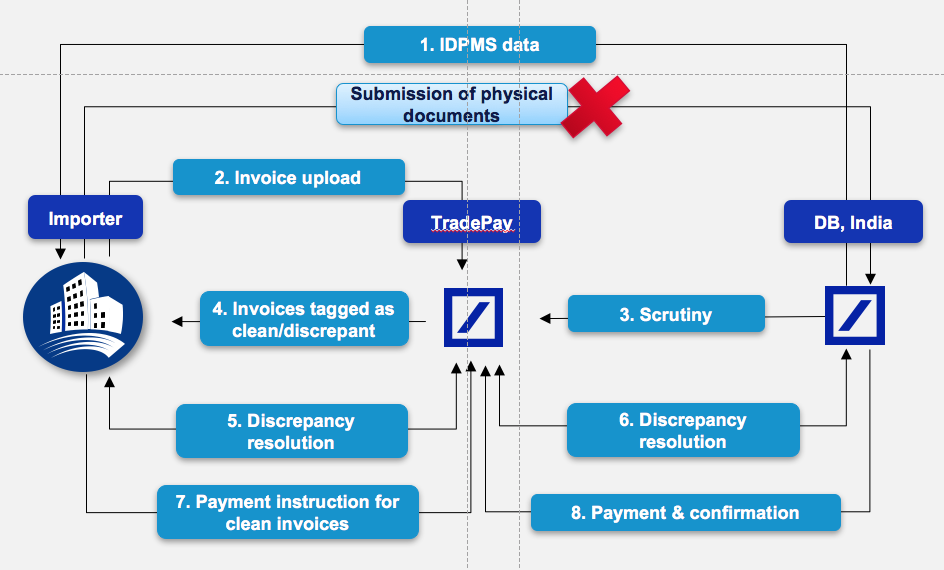

Deutsche Bank’s TradePay solution offered in India is a completely paperless solution enabling end-to-end transactions to be handled digitally. Clients are not required to submit documents either physically/scanned copies. It is a secured platform for clients to carry out all open account import payment-related activities online; including invoice details submission, discrepancy resolution, payment authorisation and reconciliation, see DB TradePay workflow below (and the removal of the submission of physical documents):

Source & Copyright©2017 - Deutsche Bank

TradePay allows clients to customise the transaction workflow as best fits using their existing set-up. The solution leverages the data available on IDPMS and on the client’s ERP system to make import payments without additional manual intervention.

Simplifying trade

Clients can then book FX contracts electronically through TradePay, to streamlining the payment process. The payment authorisation can be done directly on TradePay or via the importer’s ERP system which reduces complexities and delays in the supply chain, enhance controls and transparency of payments and increase speed of settlement, while meeting regulatory requirements.

Anjali Mohanty, Head of Global Transaction Banking – India at Deutsche Bank, said: “The role of treasurers has increasingly become more strategic. They are looking to their bankers for solutions, such as TradePay, that helps them gain more efficiencies and future-proof their business.”

Like this item? Get our Weekly Update newsletter. Subscribe today