For payments to emerging markets, it’s the n/w of local banks that really counts

by Kylene Casanova

To paraphrase Bill Clinton: for international payments, “It’s the network stupid. The rest is detail.” Global coverage in making payment to the emerging markets is made up of links and relationships with local banks, this is what is critical in transferring funds to the developing world. The biggest in this business, by far, is INTL FCStone Ltd (IFL) who has been providing global funds transfer services for over 25 years.

Global presence

IFL can make payments in local currencies to the majority of countries (175 in 140 currencies) as the map below shows:

Source & Copyright©2016 - IFL

*due to US/UK sanctions, IFL do not make payments to Iran, Cuba, North Korea and Syria.

However, it is their expertise and business model in the developing countries that enables them to offer a unique, low cost model. Over the last 30 years IFL have developed and cultivated a network of about 300 correspondent banks to support their payment services. Instead of having one correspondent bank per country, they have 2-5 banks per country to ensure that in each market they generate competition on FX rates.

Not only this, they have full-time team of people whose sole job is to travel to these countries and meet with the bank presidents, go over their financials, meet with local government officials, etc. to ensure that their correspondent network is solid, and healthy. IFL have found that they need local intelligence on both macro events which may impact rates and on any regulatory changes that may effect the payments process. Then with the real-time rates being supplied by 2-5 banks per country they can be sure of getting truly competitive rates in each country. IFL then lock in the rate for the transaction so that the client knows what it will cost them in e.g GBP and the exact amount of local currency that will be delivered to the beneficiary’s in country bank account.

Making payments to developing countries

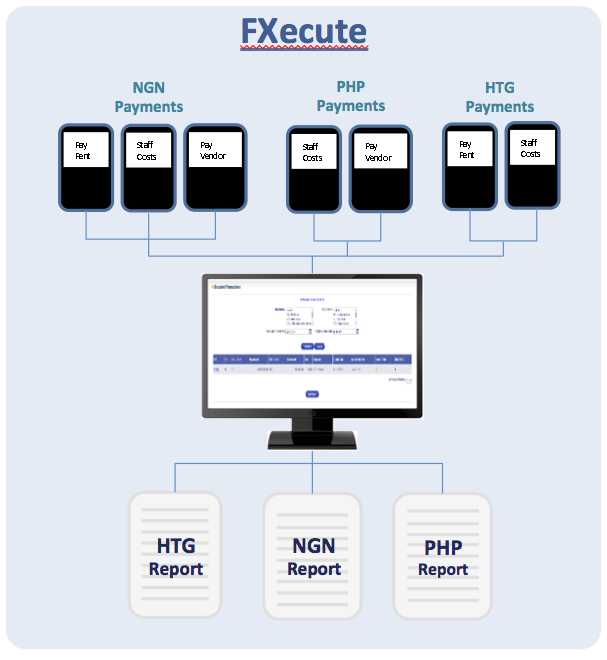

IFL have an automated platform, FXecute - see flow chart below which shows the live and executable rates for all countries and carries out the delivery of the required funds direct to the beneficiary’s account.

FXecute platform

Source & Copyright©2016 - IFL

Source & Copyright©2016 - IFL

Key features include:

- live rates for exotic currencies where IFL quote a real rate from their own database which are based on their direct contacts with local banks

- customized payments solution such as an approval process which checks whether payment within budget, batch upload capabilities

- analytic reports, e.g.

- range of security features which have ensured that the IFL payment service has never been hacked

- system integration facilities include host-to-host solutions that allow clients to transmit their payment file via a secure and automated connection, supporting a wide variety of payment file formats, encryption standards and connectivity mechanisms

- detailed audit trail that enables IFL to go direct back to the local bank where the error occurred.

Specialised requirements for payments to developing markets

To deliver funds to the developing countries IFL needs to be able to cater for local conditions, e.g.

- in Brazil: in order to make a local currency payment the beneficiary needs to hold a registration with the Central bank for reporting purposes, known as a Cadastro. IFL communicates with the beneficiary to collect all the relevant documentation in order to register the Cadastro to ensure that the Central Bank reporting requirement can be satisfied at the time the payment to the final beneficiary is made.

- in Kenya, where the local branch codes are required to make a payment, FXexcute holds these 8-digit codes in a drop-down menu.

- clients are able to solve all their global payment delivery requirements through using just one provider who is not tied to any bank, so enabling them to use an international bank in one country while in another a small local bank, picking and choosing whichever works best.

IFL’s Head of FX Payments (EMEA) Global Payment Division Gregory Vincent believes that, “The key benefit of the service is the ability to sell certainty. One of the great challenges when settling obligations in emerging markets is establishing both the upfront total cost and the final amount that will be delivered. By using its own local network, IFL are able to control the whole process and guarantee certainty on cost and delivery amount to its customers.”

Charges

Whilst IFL include their charge in the FX price quoted to the customer, the spread that they charge is marked against the genuine local market rate, which has normally been established via a competitive tendering process amongst its panel of local banks. This significantly reduces the risk that the spread paid by companies when making payments into emerging markets is actually applied to an opaque rate, one that has potentially been through several institutions before reaching the final customer. IFL’s local market access reduces the ultimate (often hidden) cost to the customer, thereby keeping IFL’s product highly competitive.

Users

IFL specialise in transferring funds to the developing world for a diverse customer base comprising around 30 banks (including 11 of the global top 30 by total assets), multi-national corporations, a large section of UN humanitarian agencies, many international aid and development agencies, government agencies and departments and central banks.

CTMfile take: Certainty of delivery of the correct amount in the local currency is what counts when sending funds to the developing countries. To do this at a fixed cost, i.e. a locked-in rate, is, to put it mildly, a very unusual business model in the global payments business. This is where IFL excel.

Like this item? Get our Weekly Update newsletter. Subscribe today