Generative AI and Agentic AI: Set to Reshape the Future of Treasury

by Pushpendra Mehta, Executive Writer, CTMfile

Artificial intelligence (AI) is rapidly becoming one of the most discussed topics in corporate treasury and finance, dominating industry conversations as teams seek to enhance efficiency, gain deeper insights for prudent decision-making, and maintain a competitive edge.

Far from being a passing trend, various credible survey results indicate that corporate treasury professionals are actively exploring AI’s potential, with a growing number looking to embed it into both operational and strategic processes. According to leading treasury consulting company Strategic Treasurer’s AI in Treasury & Finance Survey, an overwhelming majority—between 86% and 87% of corporate and bank respondents who use AI personally or for business —plan to expand their use of AI over the next year

Understanding AI in treasury requires distinguishing between Generative AI and Agentic AI, as each brings unique capabilities to finance functions.

Generative AI, as outlined in Strategic Treasurer’s recent webinar discussing the survey results, is designed to create new content—such as text, code, or scenarios—based on learned patterns in data. In a treasury context, this could include drafting policies and reports, like cash position summaries for team review, or producing FX exposure narratives to explain complex data in management reports. These capabilities allow treasury teams to save time on routine analysis while improving the clarity and consistency of reporting.

By contrast, Strategic Treasurer’s webinar highlights that Agentic AI takes automation a step further, acting autonomously to execute tasks or pursue goals based on instructions and environmental inputs. Treasury examples include detecting, matching, and resolving reconciliation exceptions across accounts without direct human intervention or performing automated FX hedge adjustments based on pre-set risk thresholds and market data feeds.

Both forms of AI are set to reshape treasury operations, offering the potential for greater efficiency, fewer errors, stronger analytic capabilities, and more strategic decision-making. As emphasized in Strategic Treasurer’s webinar, treasury and finance teams are not merely experimenting with AI—they are preparing to integrate these technologies into their daily workflows, marking a pivotal shift in the way corporate treasury functions operate. The following are key takeaways from Strategic Treasurer’s AI in Treasury & Finance Survey on the use of Generative AI and Agentic AI in treasury and finance:

Generative AI use in treasury: Consistent and growing expectations across four domains

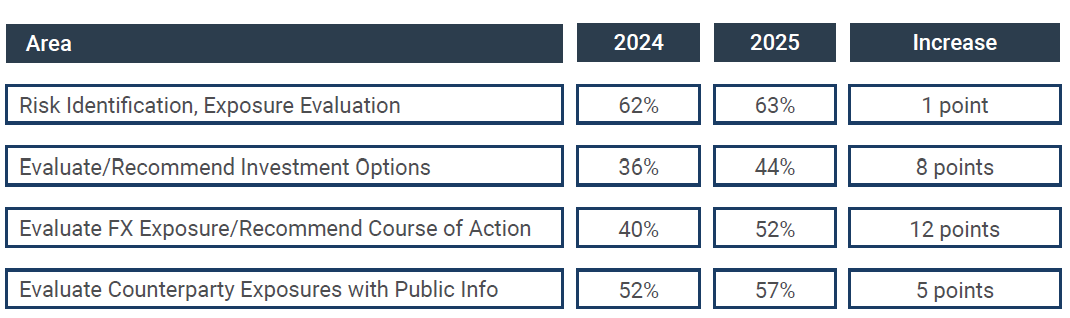

“In both years of this survey, we asked about expectations for using generative AI across four domains. Expectations around each area grew between 1 and 12 points over the past year”, states the AI survey.

Source: AI in Treasury & Finance Survey

In 2024, only two areas—Risk Identification and Exposure Evaluation (62%) and Evaluating Counterparty Exposures with Public Info (52%)—were anticipated to see use by more than half of respondents. By 2025, three out of the four domains exceeded the 50% threshold, with the remaining domain, Evaluating/Recommend Investment Options, rising from 36% to 44%, an increase of 8 points. The most significant growth occurred in Evaluating FX Exposure/Recommend Course of Action, which jumped 12 points to 52%—reflecting rising confidence in AI’s ability to support complex decision-making in currency management.

The report also observes that a notable portion of respondents remain “unsure” about generative AI adoption, particularly in FX exposures, where uncertainty ranged from 46% in 2024 to 30% in 2025. Across the other domains, year-over-year variation was minimal, further reinforcing the expectations of Generative AI adoption trends as consistent yet gradually expanding.

These findings underscore the increasing influence of generative AI in corporate treasury, driving improvements in risk assessment, investment analysis, and FX exposure management, while acting as a trusted partner in complex decision-making.

Nearly one in five treasury teams have deployed agentic AI

“Twenty-two percent of companies are already using agentic AI, and 18% of respondents indicated use within their department (treasury, finance)”, reveals the survey report. This level of adoption surpasses earlier estimates of 15%, signalling strong momentum and likely continued expansion.

The survey illustrates a clear knowledge-to-use continuum for agentic AI within organizations:

- Awareness: 72% of respondents know what agentic AI is.

- Experimentation: 32% have experimented with agentic AI, while 56% have not, and 12% are unsure.

- Company-level testing: 33% are testing agentic AI in one or more areas.

- Departmental testing: 25% are testing agentic AI in treasury and finance departments.

These findings suggest a robust pipeline for future adoption, with many organizations actively experimenting and evaluating agentic AI. Notably, while enterprise-wide use is still emerging, departmental adoption is steadily gaining traction. This reflects treasury teams’ growing interest in applying agentic AI to improve cash forecasting accuracy, strengthen working capital management, streamline payments, refine hedging strategies, boost operational efficiency, and augment overall treasury expertise.

For treasury and finance teams moving from awareness to adoption, resources such as Strategic Treasurer’s Precision & Power: The Role of AI in the Modern Treasury provide a clear foundation. The eBook explains core AI concepts, use cases, preparation strategies, and leading practices, while also outlining the distinct qualities of generative AI and agentic AI.

To translate these insights into action, Strategic Treasurer’s upcoming AI Initiatives Workshop in October will convene treasury and technology experts to share practical, finance-specific guidance on AI adoption. With its focus on actionable strategies, the workshop is designed to help teams confidently plan, evaluate, and implement AI initiatives—ensuring that AI is integrated with precision, foresight, and assurance into the modern treasury function.

⃰ Disclosure: Strategic Treasurer owns CTMfile.

Like this item? Get our Weekly Update newsletter. Subscribe today