How to detect and prevent fraud ….. Sometimes

by Jack Large

Fraud is part of business. It is a booming industry and so is fraud prevention - reports are published almost daily. The latest reports include:

- Ravelin’s Guide to Fraud detection for the on-demand economy which contained these useful ideas:

- What corporates should expect from their Payment Service Providers:

- An understanding of the basic fraud checks that a PSP undertakes

- An understanding of how the PSP handles 3DS and any other Strong Customer Authentication protocols

- Critically how a PSP can provide data back to the merchant to help with their own fraud detection

- How a PSP logs historical data, especially how it provides information on failed transactions

- How a PSP provides chargeback data (via .csv or through an API) and how it associates a chargeback with the original transaction.

- Automate fraud detection using machine learning but need to set correct fraud threshold, and vary the threshold for each market.

- What corporates should expect from their Payment Service Providers:

- TIS white paper: the four elements in the TIS security methodology:

- Information security

- Business continuity

- Infrastructure

- TIS applications.

- Kount’s 6th Annual Mobile Payments & Fraud report:

- Findings:

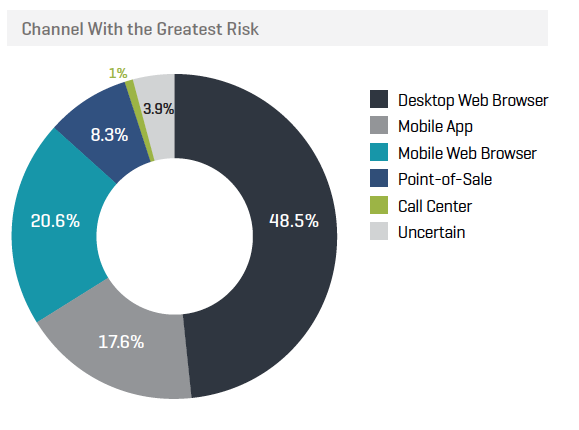

- Channel with greatest risk:

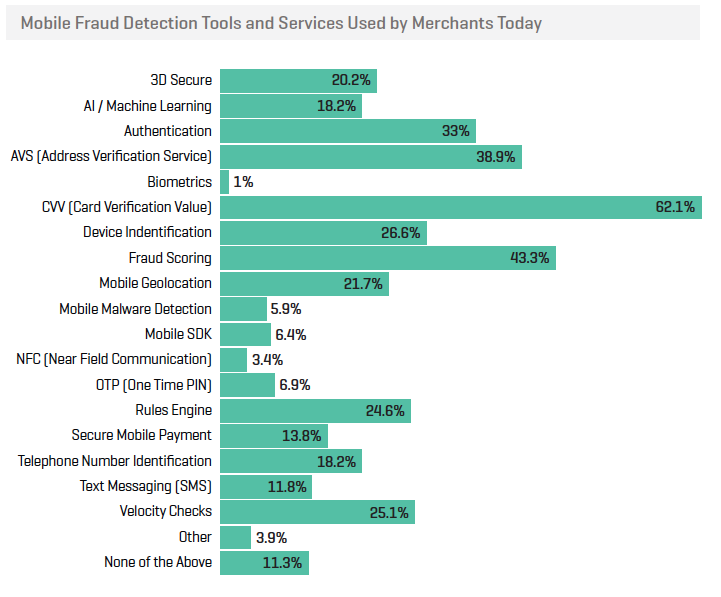

- Mobile fraud is increasing

- Tools to tackle mobile fraud include:

- Source & Copyright©2018 - Kount

- Channel with greatest risk:

- Findings:

Cyberfraud prevention checklists

CTMfile’s recommends using these Checklists to keep cyber fraudsters at bay:

- International Chamber of Commerce 'Cyber security guide for business', presenting a number of principles, strategies and actions that can help companies put a cyber security framework into practice

- The board Checklist: the vital questions

- ’10 steps to Cyber security from UK’s GCHQ’ (UK Government Communications Headquarters) who monitor the Internet and many other networks

- SANS (System Administration, Networking, and Security Institute) ‘Critical Security Controls’ —a short list of controls developed by security experts world-wide based on practices that are known to be effective in reducing cyber risks

- NIST (National Institute of Standards and Technology) Framework for Improving Critical Infrastructure Cybersecurity—combines a variety of cybersecurity standards and best practices together, see

- Shared Assessments—an organization that develops assessment questionnaires for use by its members, see

- ACFE’s Fraud Prevention Checklist, see

- ’40 questions you should have in your vendor security assessment’ from BITsight which shows how to monitor and manage vendor security.

CTMfile take: Fraud seems to be endemic, but it doesn’t have to be. Use these Checklists.

Like this item? Get our Weekly Update newsletter. Subscribe today