In UK: Pay 1.75% per chip and PIN or contactless for all major cards (even Amex)

by Jack Large

Over 50% of UK payments at point of sale, British Retail Consortium report, are now made by payment cards. Also Retail Bank Research found that the total number of e‑commerce card payments made worldwide in 2016 was up 28% on the year before and represented 9% of all card payments, and it forecasts that by 2022, 14% of all card payments will be made online.

Corporates complain about the ad-valorum (%) card fees which will become even more costly as payment cards take an increasing share of total turnover at the point of sale. So no wonder Square’s approach for small businesses is proving popular.

Square’s package

The basics:

- Accept all payments:

- With 1.75% per chip and PIN or contactless payment for all major cards (even Amex)

- deposits as fast as the next business day

- free point of sale App including inventory management, sales analytics

- No long-term commitments:

- one off price for Square reader; no rental cost

- no setup or monthly fees.

Signing up is really simple and then all the merchant needs to do is buy a Square reader and download the Square App.

User experience

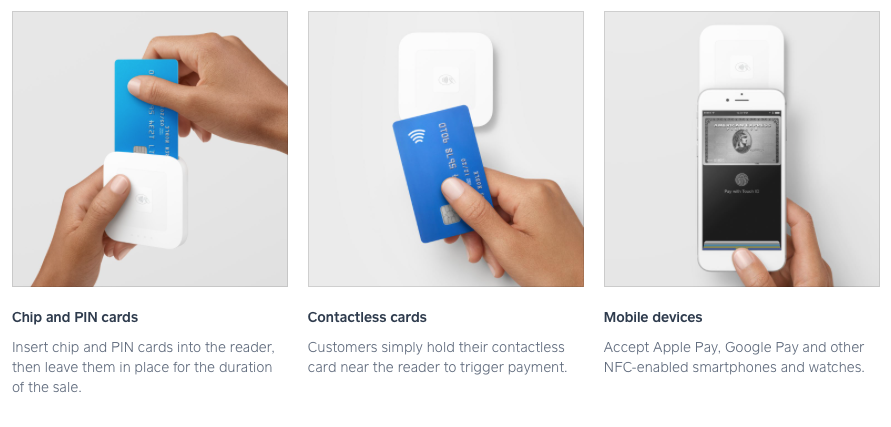

The first impact is that the new merchant can accept every way their customers want pay:

Source & Copyright©2018 - Square

Many users already depend on the inventory management and sales analysis package that is part of the Square package.

CTMfile take: Having one % charge for all cards and a multi-purpose POS terminal is vital in simplifying the whole process. Is this the future business model for larger retailers as well?

Like this item? Get our Weekly Update newsletter. Subscribe today