Poor integration = poor solution

by Jack Large

The most important thing that the API revolution has shown as is that integration is everything. Whether it's the integration of a single API or a whole new system, it is how they work together that really matters for the corporate treasury department. Two recent examples show what is happening.

FIS’s TRAX and liquidity management solution

FIS(SunGard) has been providing a payment factory solution, TRAX, for many years which has been used by some of the largest MNCs in the world. One of the problems they have continually struggled with has been how to illustrate and convince corporates how useful such a solution is. They have started publishing an ewxcellent series of electronic playbooks on Simplifying the global payments journey, each focused on a particular type of client. The FIS Pharma Playbook describes the day in the life of Thomas, the global treasurer of a pharmaceutical company. The details all the processes and actions involved, and how the TRAX solution can help. At the end it focuses on how the TRAX payment factor solution can be integrated with liquidity management processes and controls, see diagram below.

The FIS Global Corporate Payment Factory

Source & Copyright©2017 - FIS

This figure shows how FIS have integrated the cash positioning and the liquidity monitoring with the standard payment factory functionality. It is all about the integration. Make this work smoothly and the whole company sings.

Tieto’s Treasury Corporte Bank solution

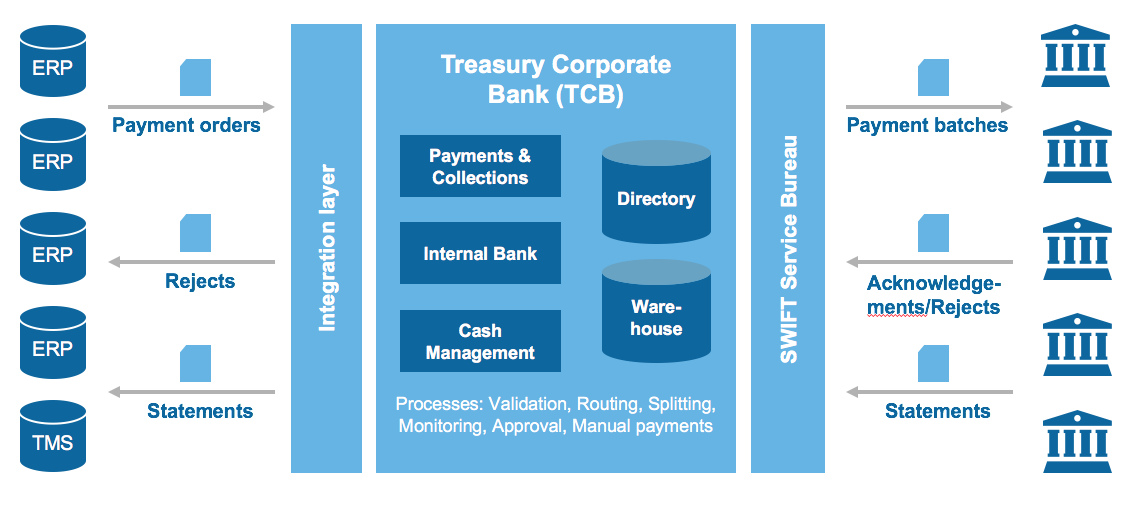

Most corporate treasurers, if they were starting from scratch (I know you cannot really, but read on) would use a structure which integrates the payment factory, the in-house bank and cash management processes with the internal financial systems and with banks and FIs, as below:

Source & Copyright©2017 - Tieto

Ah, but what about the many flavours of cash and treasury risk management that a large MNC will need as well.

Treasury management system suppliers have been expanding and integrating their systems to become ‘enterprise wide’ cash and treasury solutions from, e.g. Salmon’s, BELLIN, Kyriba, cover - to some extent - all of these areas.

But if you are a large/huge MNC with a complexity and transaction volumes way beyond these systems what what do you do?

Until the last 2-3 years, MNCs had to bring together a combination of various systems from a range of different suppliers, but now much simpler and integrated solutions are becoming available.

Tieto’s Treasury Corporate Bank

Tieto, the leading Nordic software and services company with offices in 20+ countries, have been providing payment and banking system and services for many years, in their new solution they have integrated all this experience and different systems into a a single solution which when combined with a TMS provides a complete solution to a large MNC’s cash and treasury. They call it, the Treasury Corporate Bank:

Source & Copyright©2017 - Tieto

The TCB is a complete solution for a multinational corporation with many banks and subsidiaries worldwide. TCB is, Tieto claim:

- a new generation, cost effective payment & cash management solution meeting current and future business requirements

- a parameter-driven off the shelf solution (not a “tool box”) that shortens time-to-market and facilitates automation and highest possible STP

- based on existing mission critical bank software for payments and cash management already used by global enterprises and international banks.

Implementation

The aim of the TCB is to optimise the overall efficiency and control in cash and payment processes across the entire organisation. However, to achieve this, sensitivity to and understanding of the requirements of today’s MNC is needed. Tieto have found that TCB implementation requires consideration of policies, the operational set up, the impact of bank harmonisation and the technologies and infrastructure.

CTMfile take: Any cash and treasury management solution is only as effective as the quality of the integration which isn’t, as Tieto have found, just a technological problem. Total, effective integration has many different aspects.

Like this item? Get our Weekly Update newsletter. Subscribe today