CFOs at private equity firms prioritise automation and personnel

by Kylene Casanova

Chief financial officers (CFOs) at private equity firms are focusing on the priorities of automating processes, developing personnel and improving management reporting, according to a survey of 103 private equity funds by EY.

The survey's main findings were:

- more than 40 per cent of private equity CFOs see portfolio analytics and management reporting as their top technology investments over the next two years;

- 50 per cent of CFOs viewed the right cybersecurity and automating processes as “must haves” in their operating models;

- 92 per cent of CFOs expect Millennials to stay less than five years and 51 per cent of PE CFOs say retaining their talent is integral to their future success.

EY's Scott Zimmerman said: “Private equity firms’ CFOs realise they have to build teams, retain talent and capitalise on rapidly developing technology to be competitive in the foreseeable future. People will always be most important, but today, it is also about optimizing operations through understanding the true impact of their digital agenda.”

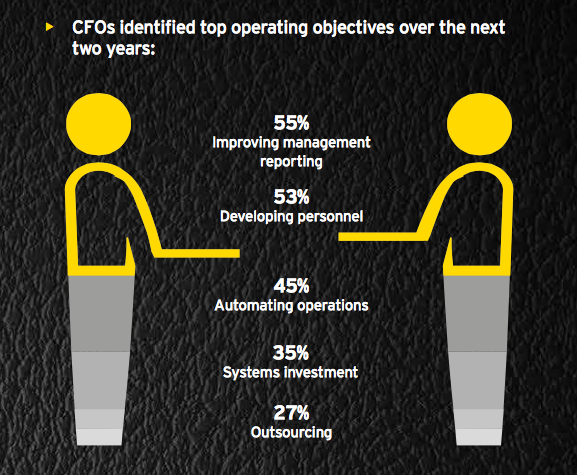

The graphic below shows that more than half of the CFOs surveyed said that their top operating objective for the next two years is to improve management reporting and to develop personnel. Forty-five per cent consider automating processes to be a priority.

The survey's key findings are summarised here.

CTMfile take: While this survey was of CFOs in private equity firms, the themes that are highlighted – maintaining and developing personnel and automation of processes – apply to CFOs and financial professionals in all sectors.

Like this item? Get our Weekly Update newsletter. Subscribe today